Bridging Private Credit and DeFi with Tokenization and AI-Driven Risk Modeling

Advanced ML models, credit oracles, and real-time on-chain infrastructure are foundational to scaling private credit asset class in DeFi

2023-01-01 • 5 mins

Share

Executive Summary

Tokenized private credit represents a significant opportunity for generating uncorrelated, sustainable yield on-chain. However, realizing this potential depends on effective risk pricing and monitoring. Advanced AI models, credit oracles, and real-time on-chain infrastructure are foundational to scaling this asset class in decentralized finance (DeFi).

Private Credit: Yield Potential and Structural Constraints

Private credit encompasses direct loans to businesses, often with customized structures and attractive yields. As traditional banks have retreated from middle-market lending, institutional investors have increasingly turned to private credit for higher returns and diversification from public markets. Despite its appeal, this asset class remains largely illiquid, opaque, and subject to long lock-up periods. These constraints present hurdles to broader participation and effective risk oversight.

Tokenization: Unlocking Liquidity and Composability

Tokenization enables the representation of real-world credit assets as blockchain-based tokens (e.g., ERC-20 equivalents), facilitating secondary market trading, collateralization, and integration with DeFi primitives. Tokenized assets become composable—usable in lending protocols, automated yield strategies, and structured products.

To date, over $600 million in private credit assets have been tokenized on-chain. While modest relative to the $2+ trillion TradFi private credit market, this marks an accelerating trend. Recent examples include tokenized deals by Apolo (ACRED), Invesco, along tokenised treasury platforms like Ondo and Franklin Templeton. On-chain tokenization allows investors to gain exposure to income-generating, uncorrelated assets with improved liquidity, while enabling faster, cheaper funding access for SME borrowers in the real world. DeFi protocols, in turn, benefit from more stable TVL backed by off-chain assets.

Risk Infrastructure for Private Credit

Unlike crypto-native loans backed by volatile assets like ETH, where there are price oracles, private credit requires bespoke risk monitoring. Traditional finance relies on rating agencies (e.g., Moody's), detailed covenants, and extensive reporting. On-chain private credit demands advanced tools: real-time data feeds, borrower health tracking, and transparency dashboards.

Early RWA experiments on-chain have highlighted the risks of inadequate monitoring, leading to bad debts. Sustainable on-chain credit requires institutional-grade infrastructure.

AI-Powered Credit Risk Modeling

The core risk metric in credit underwriting is the Probability of Default (PD). Traditional models rely on expert judgment and linear regressions. Credio adopts machine learning (ML) techniques to enhance precision and adaptability.

Credio's PD modeling approach includes:

- Logistic Regression (benchmark)

- Random Forest (ensemble model for robust performance)

- XGBoost (state-of-the-art for tabular data)

- K-Nearest Neighbors (suitable for capturing edge cases)

Each model is trained and validated on a representative dataset and evaluated using metrics such as AUC-ROC, F1-score, and accuracy. XGBoost typically delivers the strongest results. A confusion matrix from testing illustrates a realistic performance scenario:

- 950 performing loans: 930 correctly identified, 20 false positives

- 50 defaulted loans: 40 correctly flagged, 10 false negatives

This yields 80% recall on defaults and 98% specificity on performing loans—suitable for on-chain protocol integration.

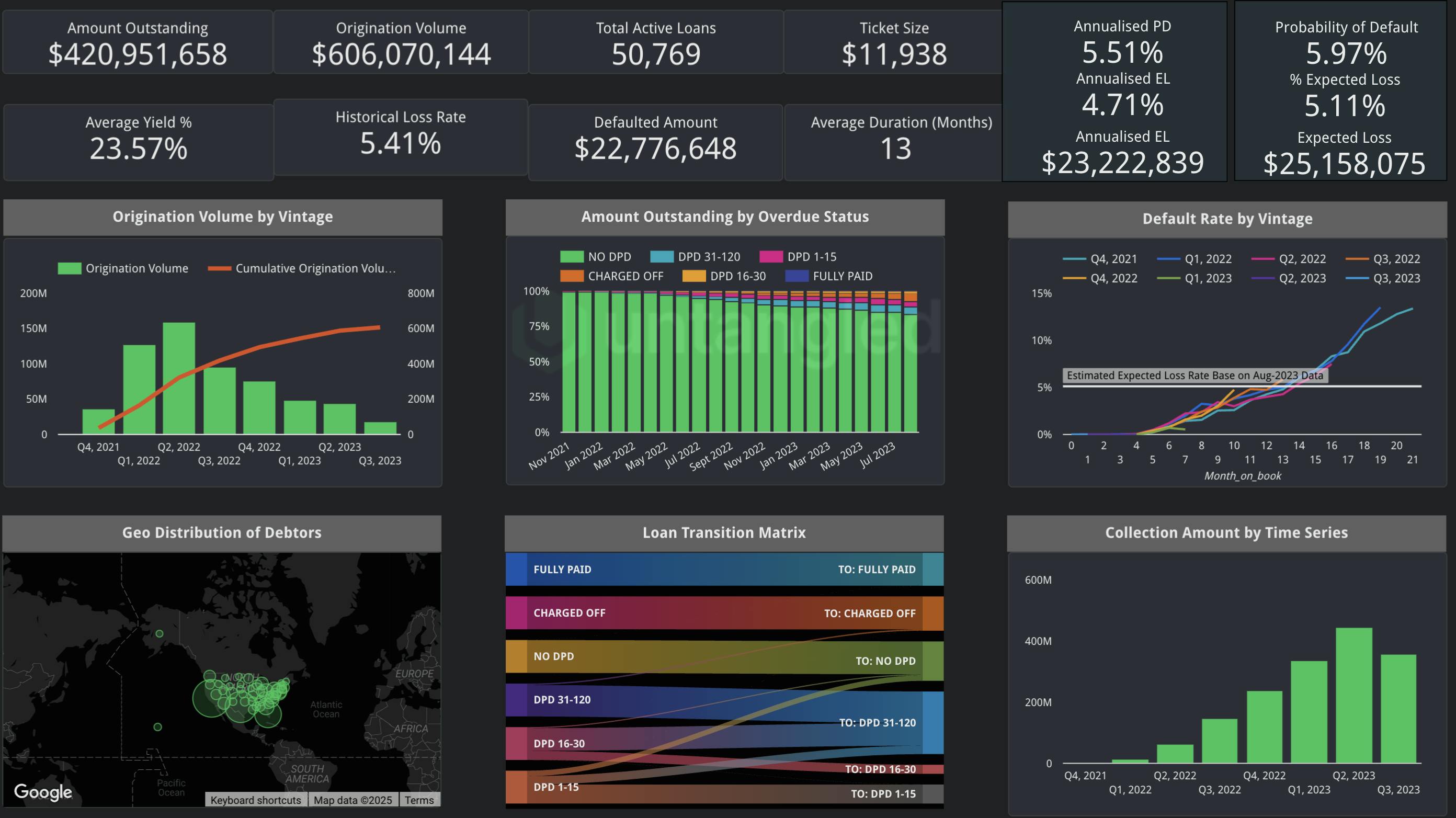

Transition Matrices for Portfolio Simulation

Rather than viewing loan performance as binary (default or not), Credio models state transitions: performing → 30-day delinquent → 90-day delinquent → default. These transitions populate a matrix used for simulations and scenario planning.

A sample transition matrix might indicate:

- 94% chance of remaining performing

- 5% chance of becoming delinquent

- 1% chance of default

This enables portfolio-level simulations across time and under macroeconomic scenarios (e.g., rising rates). It also serves as a validation check for ML output.

Expected Loss Estimation and Risk Pricing

Credio uses the standard Expected Loss (EL) formula:

EL = PD × LGD × EAD

Where:

- PD is sourced from ML models

- LGD (Loss Given Default) is based on recovery assumptions

- EAD (Exposure at Default) reflects current loan size

Expected loss estimates support pricing decisions, reserve modeling, and dynamic lending parameters. Rising EL may prompt higher reserve ratios or stricter lending criteria. Conversely, falling EL may justify increased capital efficiency.

Credit Oracles as On-Chain Primitives

Just as price oracles are foundational for protocols like Aave and Compound, credit oracles will underpin tokenized private credit. Real-time PD estimates, transition forecasts, and risk scores enable:

- Dynamic interest rate setting

- Automated collateral adjustments

- Self-regulating RWA vaults

Credio’s oracle architecture delivers real-time credit intelligence to DAOs, LPs, and fund managers. This infrastructure closes the gap between TradFi-grade underwriting and DeFi composability.

Conclusion

Tokenized private credit, when combined with real-time credit analytics, has the potential to become a core pillar of sustainable on-chain yield. By leveraging machine learning and credit oracles, platforms like Credio provide the tools necessary to manage default risk transparently and scalably.

This enables DeFi protocols to confidently lend against private credit assets, institutional investors to access diversified yield opportunities, and borrowers to secure efficient capital—all within a transparent, programmable financial system.