Risk Curator for DeFi

Credio uses proven expertise in credit strategies, AI-based risk modelling and smart contract development to transform data on risk, security and network into practical solutions contributing to the evolution of on-chain finance

Model

Protocol parameter and cashflow simulation

maximising returns while mitigating risk

Dashboard

In-depth analytics and real-time monitoring

providing strategic insights

Oracle

Decentralized risk oracle protocol delivering

automated, contextual, privacy-preserving risk data

Risk curation for DeFi

maximising returns while mitigating risk

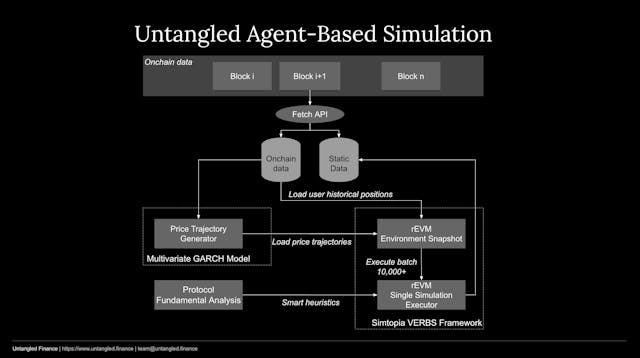

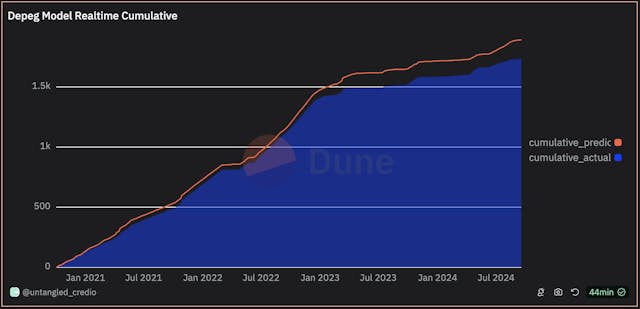

WHAT: Credio’s models focus on critical on-chain finance risks, delivering optimized risk parameters, predicting stablecoin depegging and simulating cashflow for collateral pools.

WHY: These models contribute to enhanced risk management, improve system efficiency through transparency and scale and facilitate more sophisticated use cases for growth.

HOW: Using an integrated approach, Credio combines predictive risk assessments, agent-based user behavior simulations, and cashflow modeling to continuously adjust risk parameters, anticipate depegging events, and forecast collateral flows—all in real-time and delivered seamlessly on-chain.

WHO: Credio is developed by Untangled Finance (see About below) as part of the on-chain credit infrastructure tech stack. Credio models are however tailored for each use case.

In-depth analytics and real-time monitoring providing strategic insights

WHAT

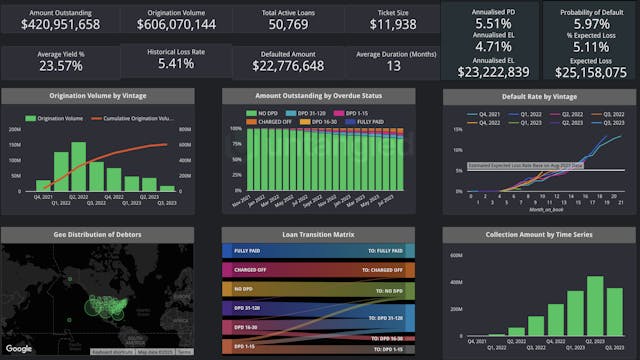

- - Risk assessment across seven indicators: issue and redemption, reserve management, market, operational, governance, regulatory and user behaviours

- - Real-time monitoring dashboards on both protocol risks/growth state and systemic risks through proprietary DeFi graph

- - Custom alerts/early warning system combining with oracle to unlock automated risk management

WHY

- - Decide to on/off board collaterals and appropriate risk parameters

- - Inform and guide risk mitigation strategies and actions

- - Provide an independent and expert view on protocol collateral risks

HOW

- - Automated data warehouse ingesting both on and off-chain data

- - Report and monitoring dashboards with quantitative and qualitative analyses providing comprehensive insights

- - Custom-built DeFi knowledge graph of N-order exposures of wallets tokens, pools, protocols, chains, bridges and oracles

Decentralized risk oracle protocol delivering

real-time, contextual, privacy-preserving risk data to DeFi applications

Proven expertise in credit strategies, AI-based risk modelling and smart contract development. Clear roadmap to a decentralised risk oracle network.

Credit investment management

Credio is built by Untangled, an on-chain credit infrastructure pioneer, in partnership with Fasanara Capital, an institutional asset manager

Risk modeling expertise

Leverage on-chain and off-chain data, we have built deep expertise in structured finance cash flow modelling, machine learning classification and agent-based models to predict and optimise risk parameters

Smart contract engineering rigor

The team have built Untangled Pools, a tokenized private credit investment platform, Untangled Vault, a non-custodial portfolio management protocol and Credio risk oracle, all with a commitment to decentralization

Work and Insights

Contact us